据英国《金融时报》6月8日报道 ,两名顶级银行家透露,由于担心西方制裁可能带来的冻结美元结算,俄罗斯公司准备在订立合同时改为用人民币或亚洲其他货币结算。

德意志银行俄罗斯负责人帕维尔·特普卢欣表示:“过去几周俄罗斯大型公司对这一市场表现出浓厚兴趣,它们开始使用很多人民币及其他亚洲货币的产品,并在亚洲地区开设账户”。

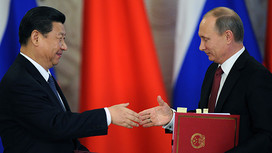

国有的俄罗斯外贸银行首席执行官安德烈·科斯京表示,扩大使用美元以外货币是该银行的“主要任务”之一。他简要地向俄罗斯总统弗拉基米尔·普京介绍说,发展使用卢布和人民币结算,是他们自5月以来的“重点”工作。

开设账户以人民币、港币和新加坡元开展贸易的举动,突显俄罗斯在与欧洲关系陷入紧张之际正试图将目光转向亚洲。

自从俄罗斯3月吞并克里米亚以来,西方制裁正推动俄罗斯公司降低对西方金融市场的依赖,同时美欧银行大幅减缓了各自在俄罗斯的放贷活动。

俄罗斯央行也在致力于创建一套支付系统,以降低俄罗斯对维萨和万事达等西方集团的依赖。

另一家欧洲大型银行的俄罗斯负责人表示:“俄罗斯试图降低对美元的依赖是很正常的,事实上这种行为完全合情合理。”他补充说,俄罗斯对美元的巨大敞口令其在危机时刻更容易受到市场波动的影响。他说:“没有理由一定要用美元结算对日贸易。”

一家70%营收来自以美元结算出口贸易的俄罗斯制造商的首席执行官表示,他的公司已经做好准备工作,一旦遭遇进一步制裁即可改变合同结算货币。他说:“一旦情况发生变化,我们已准备好改用其他货币诸如人民币或港币结算。”

俄罗斯天然气工业公司石油部门首席执行官亚历山大·久科夫表示,已与客户讨论过改用美元以外货币结算合同的可能性,而诺里尔斯克镍业(公司)对《金融时报》说,正与中国客户讨论用人民币订立长期合同的事宜。

德意志银行特普卢欣认为,“这似乎并非个例,而是一种趋势”。他还补充道,俄罗斯企业通过“变更合同允许它们在必要的时候调整结算的货币”,俄罗斯企业就可能防范未来美国进一步制裁带来的风险。

一些政客建议俄罗斯在经济上通过完全的"去美元化"来回应西方的制裁。

但是在与大公司探讨加强经济的同时,俄罗斯政府呼吁关注国内经济,用其他货币进行更多的贸易结算,而不是单一地用美元结算,俄罗斯政府拒绝了采取更多极端措施。

普京的经济顾问安德烈·别洛乌佐夫表示,“只要俄罗斯没有面临被人为地从美元体系断开的系统性制裁……那么我认为俄罗斯不会采取任何措施去人为地‘去美元化’”。

Russian companies are preparing to switch contracts to renminbi and other Asian currencies amid fears that western sanctions may freeze them out of the US dollar market, according to two top bankers.

“Over the last few weeks there has been a significant interest in the market from large Russian corporations to start using various products in renminbi and other Asian currencies and to set up accounts in Asian locations,” Pavel Teplukhin, head of Deutsche Bank in Russia, told the Financial Times.

Andrei Kostin, chief executive of state bank VTB, said that expanding the use of non-dollar currencies was one of the bank’s “main tasks”.

“Given the extent of our bilateral trade with China, developing the use of settlements in roubles and yuan [renminbi] is a priority on the agenda, and so we are working on it now,” he told Russia’s President Vladimir Putin during a briefing. “Since May, we have been carrying out this work.”

The move to open accounts to trade in renminbi, Hong Kong dollars or Singapore dollars highlights Russia’s attempt to pivot towards Asia as its relations with Europe become strained.

Sanctions are pushing Russian companies to reduce their dependence on western financial markets while US and European banks have dramatically slowed their lending activity in Russia since the annexation of Crimea in March.

The central bank is working to create a national payment system to reduce the country’s dependence on western companies such as Visa and MasterCard.

“There is nothing wrong with Russia trying to reduce its dependency on the dollar, actually it is an entirely reasonable thing to do,” said the Russia head of another large European bank. He added that Russia’s large exposure to the dollar subjects it to more market volatility in times of crisis. “There is no reason why you have to settle trade you do with Japan in dollars,” he said.

The chief executive of a Russian manufacturer that derives 70 per cent of its revenues from export in US dollars said his company had done the groundwork to move its contract settlements to different currencies in the event of further sanctions. “If something happens, we are ready to switch to other currencies, for example to the Chinese yuan or the Hong Kong dollar,” he said.

Alexander Dyukov, chief executive of Gazprom’s oil division, has said that the company has discussed with its customers the possibility of shifting contracts out of dollars, while Norilsk Nickel told the FT that it was discussing denominating long-term contracts with Chinese consumers in renminbi.

“It looks like this is not just a blip, this is a trend,” said Mr Teplukhin of Deutsche Bank. He added that Russian companies were able to hedge the risk of further US sanctions by “changing the letter of their contracts to allow them to change currency if it is necessary”.

Some politicians have suggested Moscow should respond to western sanctions by entirely “de-dollarising” its economy.

But while in recent discussions with big business about how to make the economy less vulnerable the government has advocated listing back home and settling more trade in currencies other than the dollar, it has rejected more extreme measures.

“As long as Russia is not subject to systemic sanctions, which could bring an artificial limit to our economy’s access to dollars . . . then I don’t think Russia will take any steps in order to bring about artificial de-dollarisation,” said Andrei Belousov, economic adviser to Mr Putin.